Scaling and Modeling with tidyquant

Matt Dancho

2026-01-01

Source:vignettes/TQ03-scaling-and-modeling-with-tidyquant.Rmd

TQ03-scaling-and-modeling-with-tidyquant.RmdDesigned for the data science workflow of the

tidyverse

Overview

The greatest benefit to tidyquant is the ability to

apply the data science workflow to easily model and scale your financial

analysis as described in R for

Data Science. Scaling is the process of creating an analysis

for one asset and then extending it to multiple groups. This idea of

scaling is incredibly useful to financial analysts because typically one

wants to compare many assets to make informed decisions. Fortunately,

the tidyquant package integrates with the

tidyverse making scaling super simple!

All tidyquant functions return data in the

tibble (tidy data frame) format, which allows for

interaction within the tidyverse. This means we can:

- Seamlessly scale data retrieval and mutations

- Use the pipe (

%>%) for chaining operations - Use

dplyrandtidyr:select,filter,group_by,nest/unnest,spread/gather, etc - Use

purrr: mapping functions withmap() - Model financial analysis using the data science workflow in R for Data Science

We’ll go through some useful techniques for getting and manipulating groups of data.

1.0 Scaling the Getting of Financial Data

A very basic example is retrieving the stock prices for multiple stocks. There are three primary ways to do this:

Method 1: Map a character vector with multiple stock symbols

## # A tibble: 756 × 8

## symbol date open high low close volume adjusted

## <chr> <date> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 AAPL 2016-01-04 25.7 26.3 25.5 26.3 270597600 23.8

## 2 AAPL 2016-01-05 26.4 26.5 25.6 25.7 223164000 23.2

## 3 AAPL 2016-01-06 25.1 25.6 25.0 25.2 273829600 22.7

## 4 AAPL 2016-01-07 24.7 25.0 24.1 24.1 324377600 21.7

## 5 AAPL 2016-01-08 24.6 24.8 24.2 24.2 283192000 21.9

## 6 AAPL 2016-01-11 24.7 24.8 24.3 24.6 198957600 22.2

## 7 AAPL 2016-01-12 25.1 25.2 24.7 25.0 196616800 22.5

## 8 AAPL 2016-01-13 25.1 25.3 24.3 24.3 249758400 22.0

## 9 AAPL 2016-01-14 24.5 25.1 23.9 24.9 252680400 22.4

## 10 AAPL 2016-01-15 24.0 24.4 23.8 24.3 319335600 21.9

## # ℹ 746 more rowsThe output is a single level tibble with all or the stock prices in

one tibble. The auto-generated column name is “symbol”, which can be

preemptively renamed by giving the vector a name

(e.g. stocks <- c("AAPL", "GOOG", "META")) and then

piping to tq_get.

Method 2: Map a tibble with stocks in first column

First, get a stock list in data frame format either by making the

tibble or retrieving from tq_index /

tq_exchange. The stock symbols must be in the first

column.

Method 2A: Make a tibble

stock_list <- tibble(stocks = c("AAPL", "JPM", "CVX"),

industry = c("Technology", "Financial", "Energy"))

stock_list## # A tibble: 3 × 2

## stocks industry

## <chr> <chr>

## 1 AAPL Technology

## 2 JPM Financial

## 3 CVX EnergySecond, send the stock list to tq_get. Notice how the

symbol and industry columns are automatically expanded the length of the

stock prices.

## # A tibble: 756 × 9

## stocks industry date open high low close volume adjusted

## <chr> <chr> <date> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 AAPL Technology 2016-01-04 25.7 26.3 25.5 26.3 270597600 23.8

## 2 AAPL Technology 2016-01-05 26.4 26.5 25.6 25.7 223164000 23.2

## 3 AAPL Technology 2016-01-06 25.1 25.6 25.0 25.2 273829600 22.7

## 4 AAPL Technology 2016-01-07 24.7 25.0 24.1 24.1 324377600 21.7

## 5 AAPL Technology 2016-01-08 24.6 24.8 24.2 24.2 283192000 21.9

## 6 AAPL Technology 2016-01-11 24.7 24.8 24.3 24.6 198957600 22.2

## 7 AAPL Technology 2016-01-12 25.1 25.2 24.7 25.0 196616800 22.5

## 8 AAPL Technology 2016-01-13 25.1 25.3 24.3 24.3 249758400 22.0

## 9 AAPL Technology 2016-01-14 24.5 25.1 23.9 24.9 252680400 22.4

## 10 AAPL Technology 2016-01-15 24.0 24.4 23.8 24.3 319335600 21.9

## # ℹ 746 more rowsMethod 2B: Use index or exchange

Get an index…

tq_index("DOW")## # A tibble: 31 × 8

## symbol company identifier sedol weight sector shares_held local_currency

## <chr> <chr> <chr> <chr> <dbl> <chr> <dbl> <chr>

## 1 GS GOLDMAN SAC… 38141G104 2407… 0.112 - 5692280 USD

## 2 CAT CATERPILLAR… 149123101 2180… 0.0733 - 5692280 USD

## 3 MSFT MICROSOFT C… 594918104 2588… 0.0619 - 5692280 USD

## 4 AXP AMERICAN EX… 025816109 2026… 0.0474 - 5692280 USD

## 5 V VISA INC CL… 92826C839 B2PZ… 0.0449 - 5692280 USD

## 6 HD HOME DEPOT … 437076102 2434… 0.0440 - 5692280 USD

## 7 UNH UNITEDHEALT… 91324P102 2917… 0.0422 - 5692280 USD

## 8 AMGN AMGEN INC 031162100 2023… 0.0417 - 5692280 USD

## 9 SHW SHERWIN WIL… 824348106 2804… 0.0414 - 5692280 USD

## 10 JPM JPMORGAN CH… 46625H100 2190… 0.0411 - 5692280 USD

## # ℹ 21 more rows…or, get an exchange.

tq_exchange("NYSE")Send the index or exchange to tq_get. Important

Note: This can take several minutes depending on the size of the index

or exchange, which is why only the first three stocks are evaluated in

the vignette.

## # A tibble: 7,542 × 15

## symbol company identifier sedol weight sector shares_held local_currency

## <chr> <chr> <chr> <chr> <dbl> <chr> <dbl> <chr>

## 1 GS GOLDMAN SAC… 38141G104 2407… 0.112 - 5692280 USD

## 2 GS GOLDMAN SAC… 38141G104 2407… 0.112 - 5692280 USD

## 3 GS GOLDMAN SAC… 38141G104 2407… 0.112 - 5692280 USD

## 4 GS GOLDMAN SAC… 38141G104 2407… 0.112 - 5692280 USD

## 5 GS GOLDMAN SAC… 38141G104 2407… 0.112 - 5692280 USD

## 6 GS GOLDMAN SAC… 38141G104 2407… 0.112 - 5692280 USD

## 7 GS GOLDMAN SAC… 38141G104 2407… 0.112 - 5692280 USD

## 8 GS GOLDMAN SAC… 38141G104 2407… 0.112 - 5692280 USD

## 9 GS GOLDMAN SAC… 38141G104 2407… 0.112 - 5692280 USD

## 10 GS GOLDMAN SAC… 38141G104 2407… 0.112 - 5692280 USD

## # ℹ 7,532 more rows

## # ℹ 7 more variables: date <date>, open <dbl>, high <dbl>, low <dbl>,

## # close <dbl>, volume <dbl>, adjusted <dbl>You can use any applicable “getter” to get data for every stock in an index or an exchange! This includes: “stock.prices”, “key.ratios”, “key.stats”, and more.

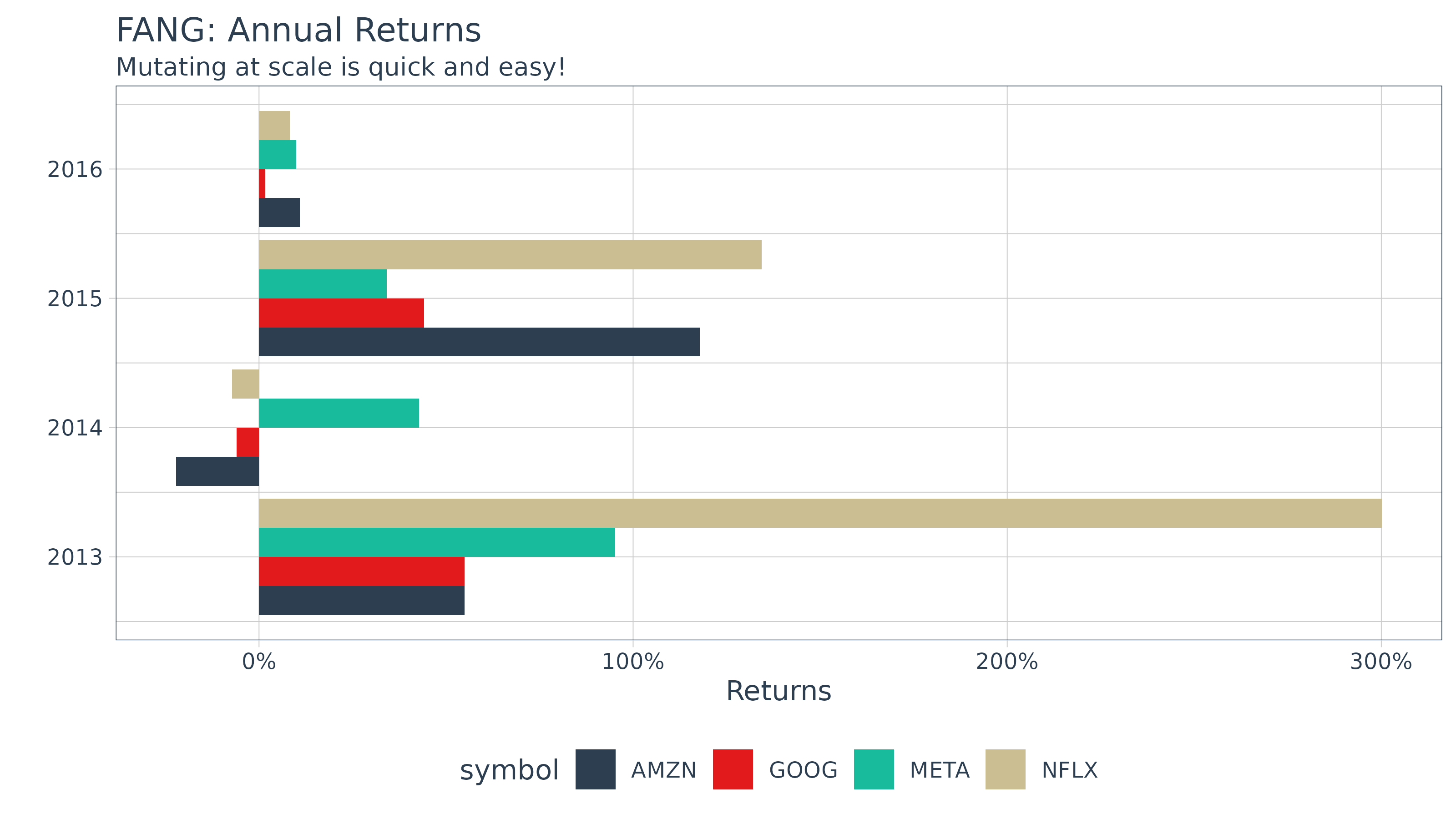

2.0 Scaling the Mutation of Financial Data

Once you get the data, you typically want to do something with it.

You can easily do this at scale. Let’s get the yearly returns for

multiple stocks using tq_transmute. First, get the prices.

We’ll use the FANG data set, but you typically will use

tq_get to retrieve data in “tibble” format.

FANG## # A tibble: 4,032 × 8

## symbol date open high low close volume adjusted

## <chr> <date> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 META 2013-01-02 27.4 28.2 27.4 28 69846400 28

## 2 META 2013-01-03 27.9 28.5 27.6 27.8 63140600 27.8

## 3 META 2013-01-04 28.0 28.9 27.8 28.8 72715400 28.8

## 4 META 2013-01-07 28.7 29.8 28.6 29.4 83781800 29.4

## 5 META 2013-01-08 29.5 29.6 28.9 29.1 45871300 29.1

## 6 META 2013-01-09 29.7 30.6 29.5 30.6 104787700 30.6

## 7 META 2013-01-10 30.6 31.5 30.3 31.3 95316400 31.3

## 8 META 2013-01-11 31.3 32.0 31.1 31.7 89598000 31.7

## 9 META 2013-01-14 32.1 32.2 30.6 31.0 98892800 31.0

## 10 META 2013-01-15 30.6 31.7 29.9 30.1 173242600 30.1

## # ℹ 4,022 more rowsSecond, use group_by to group by stock symbol. Third,

apply the mutation. We can do this in one easy workflow. The

periodReturn function is applied to each group of stock

prices, and a new data frame was returned with the annual returns in the

correct periodicity.

FANG_returns_yearly <- FANG %>%

group_by(symbol) %>%

tq_transmute(select = adjusted,

mutate_fun = periodReturn,

period = "yearly",

col_rename = "yearly.returns") Last, we can visualize the returns.

FANG_returns_yearly %>%

ggplot(aes(x = year(date), y = yearly.returns, fill = symbol)) +

geom_bar(position = "dodge", stat = "identity") +

labs(title = "FANG: Annual Returns",

subtitle = "Mutating at scale is quick and easy!",

y = "Returns", x = "", color = "") +

scale_y_continuous(labels = scales::percent) +

coord_flip() +

theme_tq() +

scale_fill_tq()

3.0 Modeling Financial Data using purrr

Eventually you will want to begin modeling (or more generally

applying functions) at scale! One of the best features

of the tidyverse is the ability to map functions to nested

tibbles using purrr. From the Many Models chapter of “R for Data Science”, we can apply the

same modeling workflow to financial analysis. Using a two step

workflow:

- Model a single stock

- Scale to many stocks

Let’s go through an example to illustrate.

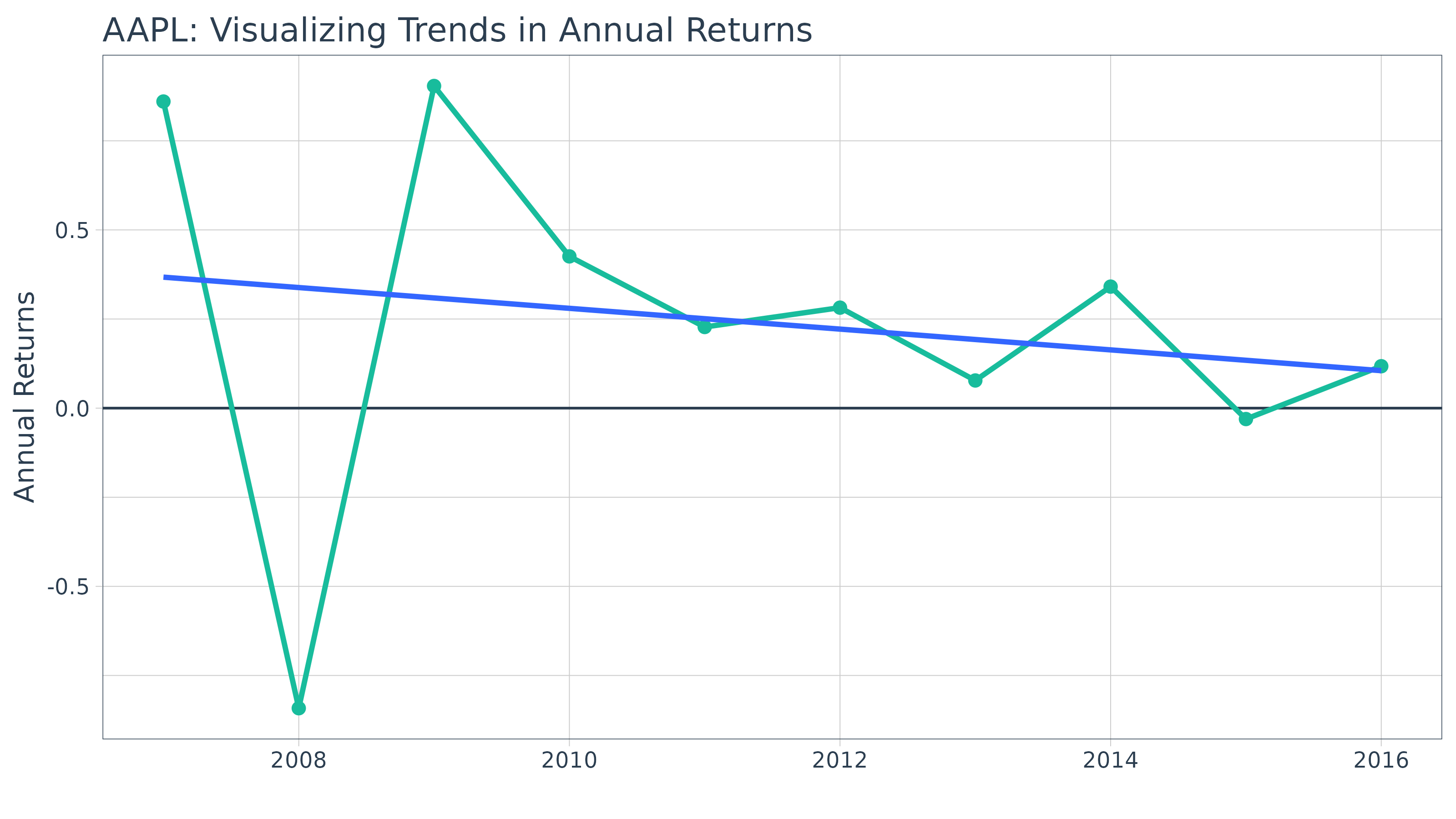

Example: Applying a Regression Model to Detect a Positive Trend

In this example, we’ll use a simple linear model to identify the trend in annual returns to determine if the stock returns are decreasing or increasing over time.

Analyze a Single Stock

First, let’s collect stock data with tq_get()

AAPL <- tq_get("AAPL", from = "2007-01-01", to = "2016-12-31")

AAPL## # A tibble: 2,518 × 8

## symbol date open high low close volume adjusted

## <chr> <date> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 AAPL 2007-01-03 3.08 3.09 2.92 2.99 1238319600 2.51

## 2 AAPL 2007-01-04 3.00 3.07 2.99 3.06 847260400 2.57

## 3 AAPL 2007-01-05 3.06 3.08 3.01 3.04 834741600 2.55

## 4 AAPL 2007-01-08 3.07 3.09 3.05 3.05 797106800 2.56

## 5 AAPL 2007-01-09 3.09 3.32 3.04 3.31 3349298400 2.78

## 6 AAPL 2007-01-10 3.38 3.49 3.34 3.46 2952880000 2.91

## 7 AAPL 2007-01-11 3.43 3.46 3.40 3.42 1440252800 2.87

## 8 AAPL 2007-01-12 3.38 3.39 3.33 3.38 1312690400 2.84

## 9 AAPL 2007-01-16 3.42 3.47 3.41 3.47 1244076400 2.91

## 10 AAPL 2007-01-17 3.48 3.49 3.39 3.39 1646260000 2.85

## # ℹ 2,508 more rowsNext, come up with a function to help us collect annual log returns.

The function below mutates the stock prices to period returns using

tq_transmute(). We add the type = "log" and

period = "monthly" arguments to ensure we retrieve a tibble

of monthly log returns. Last, we take the mean of the monthly returns to

get MMLR.

get_annual_returns <- function(stock.returns) {

stock.returns %>%

tq_transmute(select = adjusted,

mutate_fun = periodReturn,

type = "log",

period = "yearly")

}Let’s test get_annual_returns out. We now have the

annual log returns over the past ten years.

AAPL_annual_log_returns <- get_annual_returns(AAPL)

AAPL_annual_log_returns## # A tibble: 10 × 2

## date yearly.returns

## <date> <dbl>

## 1 2007-12-31 0.860

## 2 2008-12-31 -0.842

## 3 2009-12-31 0.904

## 4 2010-12-31 0.426

## 5 2011-12-30 0.228

## 6 2012-12-31 0.282

## 7 2013-12-31 0.0776

## 8 2014-12-31 0.341

## 9 2015-12-31 -0.0306

## 10 2016-12-30 0.118Let’s visualize to identify trends. We can see from the linear trend line that AAPL’s stock returns are declining.

AAPL_annual_log_returns %>%

ggplot(aes(x = year(date), y = yearly.returns)) +

geom_hline(yintercept = 0, color = palette_light()[[1]]) +

geom_point(size = 2, color = palette_light()[[3]]) +

geom_line(linewidth = 1, color = palette_light()[[3]]) +

geom_smooth(method = "lm", se = FALSE) +

labs(title = "AAPL: Visualizing Trends in Annual Returns",

x = "", y = "Annual Returns", color = "") +

theme_tq()

Now, we can get the linear model using the lm()

function. However, there is one problem: the output is not “tidy”.

##

## Call:

## lm(formula = yearly.returns ~ year(date), data = AAPL_annual_log_returns)

##

## Coefficients:

## (Intercept) year(date)

## 58.86282 -0.02915We can utilize the broom package to get “tidy” data from

the model. There’s three primary functions:

-

augment: adds columns to the original data such as predictions, residuals and cluster assignments -

glance: provides a one-row summary of model-level statistics -

tidy: summarizes a model’s statistical findings such as coefficients of a regression

We’ll use tidy to retrieve the model coefficients.

## # A tibble: 2 × 5

## term estimate std.error statistic p.value

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 (Intercept) 58.9 113. 0.520 0.617

## 2 year(date) -0.0291 0.0562 -0.518 0.618Adding to our workflow, we have the following:

get_model <- function(stock_data) {

annual_returns <- get_annual_returns(stock_data)

mod <- lm(yearly.returns ~ year(date), data = annual_returns)

tidy(mod)

}Testing it out on a single stock. We can see that the “term” that contains the direction of the trend (the slope) is “year(date)”. The interpretation is that as year increases one unit, the annual returns decrease by 3%.

get_model(AAPL)## # A tibble: 2 × 5

## term estimate std.error statistic p.value

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 (Intercept) 58.9 113. 0.520 0.617

## 2 year(date) -0.0291 0.0562 -0.518 0.618Now that we have identified the trend direction, it looks like we are ready to scale.

Scale to Many Stocks

Once the analysis for one stock is done scale to many stocks is

simple. For brevity, we’ll randomly sample ten stocks from the

S&P500 with a call to dplyr::sample_n().

## # A tibble: 5 × 8

## symbol company identifier sedol weight sector shares_held local_currency

## <chr> <chr> <chr> <chr> <dbl> <chr> <dbl> <chr>

## 1 MGM MGM RESORTS… 552953101 2547… 1.30e-4 - 2541251 USD

## 2 AON AON PLC CLA… G0403H108 BLP1… 1.30e-3 - 2618679 USD

## 3 CFG CITIZENS FI… 174610105 BQRX… 4.29e-4 - 5231385 USD

## 4 IP INTERNATION… 460146103 2465… 3.53e-4 - 6397135 USD

## 5 DOC HEALTHPEAK … 42250P103 BJBL… 1.93e-4 - 8585966 USDWe can now apply our analysis function to the stocks using

dplyr::mutate() and purrr::map(). The

mutate() function adds a column to our tibble, and the

map() function maps our custom get_model

function to our tibble of stocks using the symbol column.

The tidyr::unnest() function unrolls the nested data frame

so all of the model statistics are accessible in the top data frame

level. The filter, arrange and

select steps just manipulate the data frame to isolate and

arrange the data for our viewing.

stocks_model_stats <- stocks_tbl %>%

select(symbol, company) %>%

tq_get(from = "2007-01-01", to = "2016-12-31") %>%

# Nest

group_by(symbol, company) %>%

nest() %>%

# Apply the get_model() function to the new "nested" data column

mutate(model = map(data, get_model)) %>%

# Unnest and collect slope

unnest(model) %>%

filter(term == "year(date)") %>%

arrange(desc(estimate)) %>%

select(-term)

stocks_model_stats## # A tibble: 5 × 7

## # Groups: symbol, company [5]

## symbol company data estimate std.error statistic p.value

## <chr> <chr> <list> <dbl> <dbl> <dbl> <dbl>

## 1 CFG CITIZENS FINANCIAL GROUP <tibble> 0.125 0.0780 1.60 0.356

## 2 MGM MGM RESORTS INTERNATIONAL <tibble> 0.0880 0.0763 1.15 0.282

## 3 IP INTERNATIONAL PAPER CO <tibble> 0.0335 0.0544 0.616 0.555

## 4 AON AON PLC CLASS A <tibble> 0.00845 0.0201 0.421 0.685

## 5 DOC HEALTHPEAK PROPERTIES INC <tibble> -0.00705 0.0193 -0.365 0.725We’re done! We now have the coefficient of the linear regression that

tracks the direction of the trend line. We can easily extend this type

of analysis to larger lists or stock indexes. For example, the entire

S&P500 could be analyzed removing the sample_n()

following the call to tq_index("SP500").

4.0 Error Handling when Scaling

Eventually you will run into a stock index, stock symbol, FRED data code, etc that cannot be retrieved. Possible reasons are:

- An index becomes out of date

- A company goes private

- A stock ticker symbol changes

- Yahoo / FRED just doesn’t like your stock symbol / FRED code

This becomes painful when scaling if the functions return errors. So,

the tq_get() function is designed to handle errors

gracefully. What this means is an NA value is

returned when an error is generated along with a gentle error

warning.

tq_get("XYZ", "stock.prices")## # A tibble: 2,514 × 8

## symbol date open high low close volume adjusted

## <chr> <date> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 XYZ 2016-01-04 12.8 12.9 12.1 12.2 2751500 12.2

## 2 XYZ 2016-01-05 12.2 12.3 11.5 11.5 2352800 11.5

## 3 XYZ 2016-01-06 11.5 11.6 11.0 11.5 1850600 11.5

## 4 XYZ 2016-01-07 11.1 11.4 11 11.2 1636000 11.2

## 5 XYZ 2016-01-08 11.2 11.5 11.2 11.3 587300 11.3

## 6 XYZ 2016-01-11 11.4 11.9 11.4 11.8 1676900 11.8

## 7 XYZ 2016-01-12 11.9 12.2 11.7 12.1 2136100 12.1

## 8 XYZ 2016-01-13 12.1 12.2 11.1 11.6 2095200 11.6

## 9 XYZ 2016-01-14 11.5 11.6 10.8 10.8 1604900 10.8

## 10 XYZ 2016-01-15 10.6 10.8 10.1 10.3 1203700 10.3

## # ℹ 2,504 more rowsPros and Cons to Built-In Error-Handling

There are pros and cons to this approach that you may not agree with, but I believe helps in the long run. Just be aware of what happens:

Pros: Long running scripts are not interrupted because of one error

Cons: Errors can be inadvertently handled or flow downstream if the user does not read the warnings

Bad Apples Fail Gracefully, tq_get

Let’s see an example when using tq_get() to get the

stock prices for a long list of stocks with one BAD APPLE.

The argument complete_cases comes in handy. The default is

TRUE, which removes “bad apples” so future analysis have

complete cases to compute on. Note that a gentle warning stating that an

error occurred and was dealt with by removing the rows from the

results.

## Warning: There was 1 warning in `dplyr::mutate()`.

## ℹ In argument: `data.. = purrr::map(...)`.

## Caused by warning:

## ! x = 'BAD APPLE', get = 'stock.prices': Error in getSymbols.yahoo(Symbols = "BAD APPLE", env = <environment>, : Unable to import "BAD APPLE".

## cannot open the connection

## Removing BAD APPLE.## # A tibble: 5,028 × 8

## symbol date open high low close volume adjusted

## <chr> <date> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 AAPL 2016-01-04 25.7 26.3 25.5 26.3 270597600 23.8

## 2 AAPL 2016-01-05 26.4 26.5 25.6 25.7 223164000 23.2

## 3 AAPL 2016-01-06 25.1 25.6 25.0 25.2 273829600 22.7

## 4 AAPL 2016-01-07 24.7 25.0 24.1 24.1 324377600 21.7

## 5 AAPL 2016-01-08 24.6 24.8 24.2 24.2 283192000 21.9

## 6 AAPL 2016-01-11 24.7 24.8 24.3 24.6 198957600 22.2

## 7 AAPL 2016-01-12 25.1 25.2 24.7 25.0 196616800 22.5

## 8 AAPL 2016-01-13 25.1 25.3 24.3 24.3 249758400 22.0

## 9 AAPL 2016-01-14 24.5 25.1 23.9 24.9 252680400 22.4

## 10 AAPL 2016-01-15 24.0 24.4 23.8 24.3 319335600 21.9

## # ℹ 5,018 more rowsNow switching complete_cases = FALSE will retain any

errors as NA values in a nested data frame. Notice that the

error message and output change. The error message now states that the

NA values exist in the output and the return is a “nested”

data structure.

## Warning: There was 1 warning in `dplyr::mutate()`.

## ℹ In argument: `data.. = purrr::map(...)`.

## Caused by warning:

## ! x = 'BAD APPLE', get = 'stock.prices': Error in getSymbols.yahoo(Symbols = "BAD APPLE", env = <environment>, : Unable to import "BAD APPLE".

## cannot open the connection## # A tibble: 5,029 × 8

## symbol date open high low close volume adjusted

## <chr> <date> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 AAPL 2016-01-04 25.7 26.3 25.5 26.3 270597600 23.8

## 2 AAPL 2016-01-05 26.4 26.5 25.6 25.7 223164000 23.2

## 3 AAPL 2016-01-06 25.1 25.6 25.0 25.2 273829600 22.7

## 4 AAPL 2016-01-07 24.7 25.0 24.1 24.1 324377600 21.7

## 5 AAPL 2016-01-08 24.6 24.8 24.2 24.2 283192000 21.9

## 6 AAPL 2016-01-11 24.7 24.8 24.3 24.6 198957600 22.2

## 7 AAPL 2016-01-12 25.1 25.2 24.7 25.0 196616800 22.5

## 8 AAPL 2016-01-13 25.1 25.3 24.3 24.3 249758400 22.0

## 9 AAPL 2016-01-14 24.5 25.1 23.9 24.9 252680400 22.4

## 10 AAPL 2016-01-15 24.0 24.4 23.8 24.3 319335600 21.9

## # ℹ 5,019 more rowsIn both cases, the prudent user will review the warnings to determine

what happened and whether or not this is acceptable. In the

complete_cases = FALSE example, if the user attempts to

perform downstream computations at scale, the computations will likely

fail grinding the analysis to a halt. But, the advantage is that the

user will more easily be able to filter to the problem root to determine

what happened and decide whether this is acceptable or not.