Introduction to sweep

Matt Dancho

2025-08-28

Source:vignettes/SW00_Introduction_to_sweep.Rmd

SW00_Introduction_to_sweep.RmdExtending

broomto time series forecasting

The sweep package extends the broom tools

(tidy, glance, and augment) for performing forecasts and time series

analysis in the “tidyverse”. The package is geared towards the workflow

required to perform forecasts using Rob Hyndman’s forecast

package, and contains the following elements:

model tidiers:

sw_tidy,sw_glance,sw_augment,sw_tidy_decompfunctions extendtidy,glance, andaugmentfrom thebroompackage specifically for models (ets(),Arima(),bats(), etc) used for forecasting.forecast tidier:

sw_sweepconverts aforecastobject to a tibble that can be easily manipulated in the “tidyverse”.

To illustrate, let’s take a basic forecasting workflow starting from data collected in a tibble format and then performing a forecast to achieve the end result in tibble format.

Forecasting Sales of Beer, Wine, and Distilled Alcohol Beverages

We’ll use the tidyquant package to get the US alcohol

sales, which comes from the FRED data base (the origin is the US Bureau

of the Census, one of the 80+ data sources FRED connects to). The FRED

code is “S4248SM144NCEN” and the data set can be found here.

alcohol_sales_tbl <- tq_get("S4248SM144NCEN",

get = "economic.data",

from = "2007-01-01",

to = "2016-12-31")

alcohol_sales_tbl## # A tibble: 120 × 3

## symbol date price

## <chr> <date> <int>

## 1 S4248SM144NCEN 2007-01-01 6627

## 2 S4248SM144NCEN 2007-02-01 6743

## 3 S4248SM144NCEN 2007-03-01 8195

## 4 S4248SM144NCEN 2007-04-01 7828

## 5 S4248SM144NCEN 2007-05-01 9570

## 6 S4248SM144NCEN 2007-06-01 9484

## 7 S4248SM144NCEN 2007-07-01 8608

## 8 S4248SM144NCEN 2007-08-01 9543

## 9 S4248SM144NCEN 2007-09-01 8123

## 10 S4248SM144NCEN 2007-10-01 9649

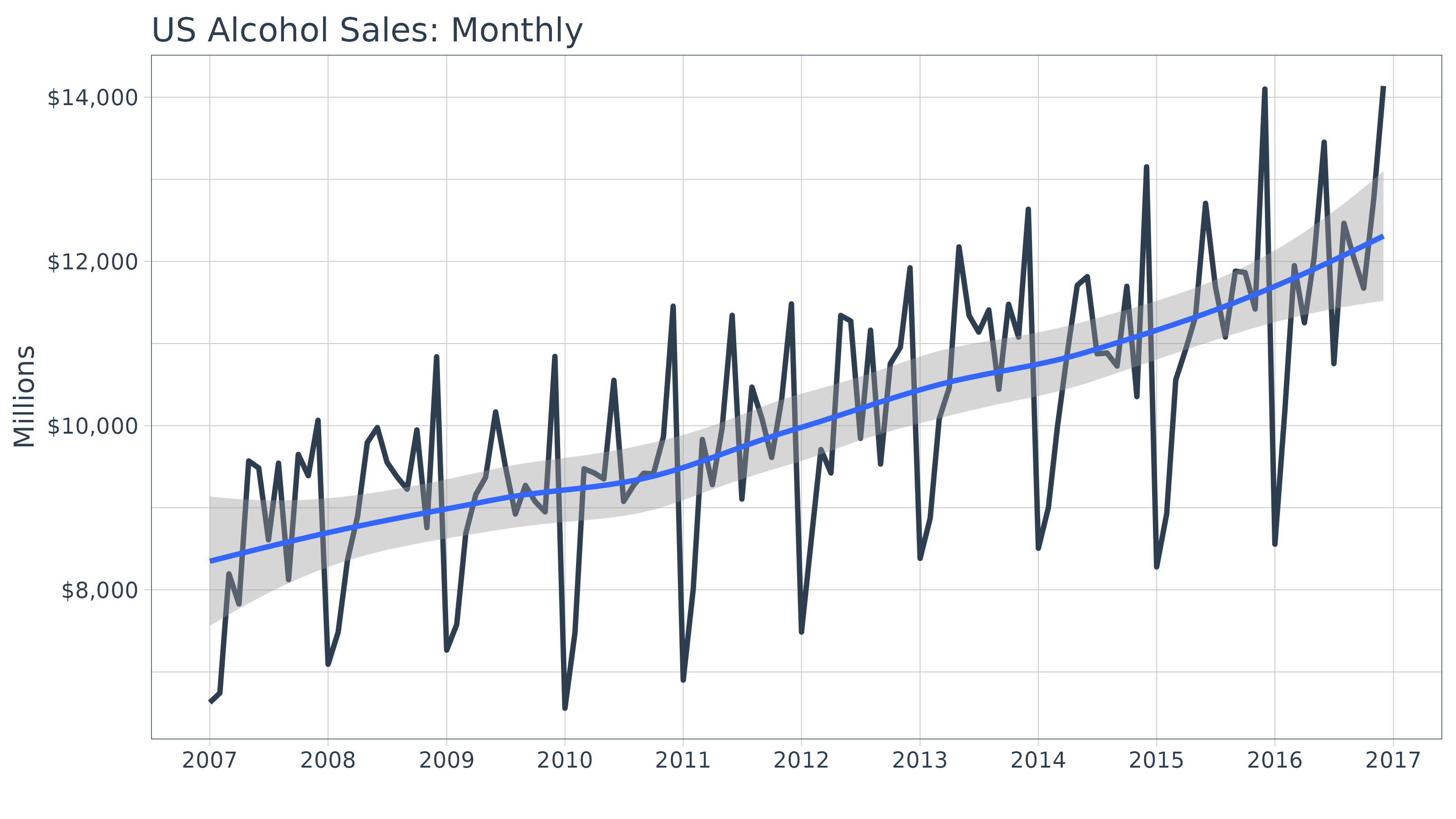

## # ℹ 110 more rowsWe can quickly visualize using the ggplot2 package. We

can see that there appears to be some seasonality and an upward

trend.

alcohol_sales_tbl %>%

ggplot(aes(x = date, y = price)) +

geom_line(linewidth = 1, color = palette_light()[[1]]) +

geom_smooth(method = "loess") +

labs(title = "US Alcohol Sales: Monthly", x = "", y = "Millions") +

scale_y_continuous(labels = scales::dollar) +

scale_x_date(date_breaks = "1 year", date_labels = "%Y") +

theme_tq()## `geom_smooth()` using formula = 'y ~ x'

Forecasting Workflow

The forecasting workflow involves a few basic steps:

- Step 1: Coerce to a

tsobject class. - Step 2: Apply a model (or set of models)

- Step 3: Forecast the models (similar to predict)

- Step 4: Use

sw_sweep()to tidy the forecast.

Note that we purposely omit other steps such as testing the

series for stationarity (Box.test(type = "Ljung")) and

analysis of autocorrelations (Acf, Pacf) for

brevity purposes. We recommend the analyst to follow the forecasting

workflow in “Forecasting: principles

and practice”

Step 1: Coerce to a ts object class

The forecast package uses the ts data

structure, which is quite a bit different than tibbles that we are

currently using. Fortunately, it’s easy to get to the correct structure

with tk_ts() from the timetk package. The

start and freq variables are required for the

regularized time series (ts) class, and these specify how

to treat the time series. For monthly, the frequency should be specified

as 12. This results in a nice calendar view. The

silent = TRUE tells the tk_ts() function to

skip the warning notifying us that the “date” column is being dropped.

Non-numeric columns must be dropped for ts class, which is

matrix based and a homogeneous data class.

alcohol_sales_ts <- tk_ts(alcohol_sales_tbl, start = 2007, freq = 12, silent = TRUE)

alcohol_sales_ts## Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

## 2007 6627 6743 8195 7828 9570 9484 8608 9543 8123 9649 9390 10065

## 2008 7093 7483 8365 8895 9794 9977 9553 9375 9225 9948 8758 10839

## 2009 7266 7578 8688 9162 9369 10167 9507 8923 9272 9075 8949 10843

## 2010 6558 7481 9475 9424 9351 10552 9077 9273 9420 9413 9866 11455

## 2011 6901 8014 9832 9281 9967 11344 9106 10469 10085 9612 10328 11483

## 2012 7486 8641 9709 9423 11342 11274 9845 11163 9532 10754 10953 11922

## 2013 8384 8871 10085 10462 12177 11342 11139 11408 10441 11480 11077 12635

## 2014 8505 9003 9991 10903 11709 11814 10875 10885 10725 11698 10353 13153

## 2015 8279 8926 10557 10934 11330 12709 11700 11078 11882 11865 11420 14099

## 2016 8555 10197 11948 11253 12046 13454 10755 12465 12038 11674 12762 14139A significant benefit is that the resulting ts object

maintains a “timetk index”, which will help with forecasting dates

later. We can verify this using has_timetk_idx() from the

timetk package.

has_timetk_idx(alcohol_sales_ts)## [1] TRUENow that a time series has been coerced, let’s proceed with modeling.

Step 2: Modeling a time series

The modeling workflow takes a time series object and applies a model.

Nothing new here: we’ll simply use the ets() function from

the forecast package to get an Exponential Smoothing ETS

(Error, Trend, Seasonal) model.

Where sweep can help is in the evaluation of a model.

Expanding on the broom package there are four

functions:

-

sw_tidy(): Returns a tibble of model parameters -

sw_glance(): Returns the model accuracy measurements -

sw_augment(): Returns the fitted and residuals of the model -

sw_tidy_decomp(): Returns a tidy decomposition from a model

The guide below shows which model object compatibility with

sweep tidier functions.

| Object | sw_tidy() | sw_glance() | sw_augment() | sw_tidy_decomp() | sw_sweep() |

|---|---|---|---|---|---|

| ar | |||||

| arima | X | X | X | ||

| Arima | X | X | X | ||

| ets | X | X | X | X | |

| baggedETS | |||||

| bats | X | X | X | X | |

| tbats | X | X | X | X | |

| nnetar | X | X | X | ||

| stl | X | ||||

| HoltWinters | X | X | X | X | |

| StructTS | X | X | X | X | |

| tslm | X | X | X | ||

| decompose | X | ||||

| adf.test | X | X | |||

| Box.test | X | X | |||

| kpss.test | X | X | |||

| forecast | X |

Going through the tidiers, we can get useful model

information.

sw_tidy

sw_tidy() returns the model parameters.

sw_tidy(fit_ets)## # A tibble: 17 × 2

## term estimate

## <chr> <dbl>

## 1 alpha 0.149

## 2 beta 0.0173

## 3 gamma 0.000110

## 4 phi 0.974

## 5 l 8389.

## 6 b 39.1

## 7 s0 1.18

## 8 s1 1.02

## 9 s2 1.04

## 10 s3 0.995

## 11 s4 1.04

## 12 s5 0.997

## 13 s6 1.12

## 14 s7 1.07

## 15 s8 0.981

## 16 s9 0.973

## 17 s10 0.835sw_glance

sw_glance() returns the model quality parameters.

sw_glance(fit_ets)## # A tibble: 1 × 12

## model.desc sigma logLik AIC BIC ME RMSE MAE MPE MAPE MASE

## <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 ETS(M,Ad,M) 0.0458 -1012. 2060. 2110. 37.4 430. 355. 0.199 3.52 0.701

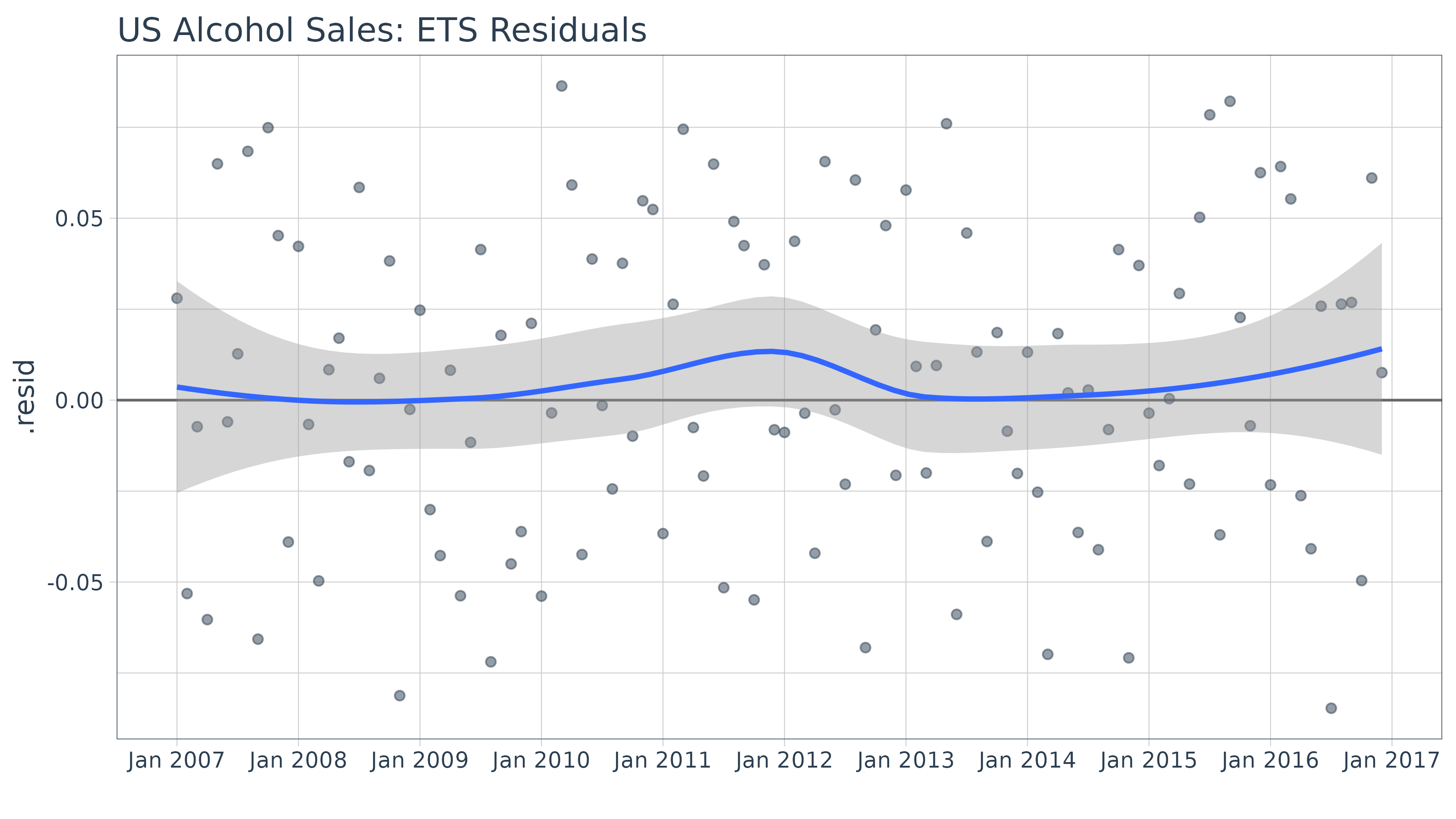

## # ℹ 1 more variable: ACF1 <dbl>sw_augment

sw_augment() returns the actual, fitted and residual

values.

augment_fit_ets <- sw_augment(fit_ets)

augment_fit_ets## # A tibble: 120 × 4

## index .actual .fitted .resid

## <yearmon> <dbl> <dbl> <dbl>

## 1 Jan 2007 6627 6440. 0.0291

## 2 Feb 2007 6743 7105. -0.0510

## 3 Mar 2007 8195 8245. -0.00609

## 4 Apr 2007 7828 8333. -0.0606

## 5 May 2007 9570 9001. 0.0633

## 6 Jun 2007 9484 9552. -0.00716

## 7 Jul 2007 8608 8544. 0.00747

## 8 Aug 2007 9543 8919. 0.0699

## 9 Sep 2007 8123 8696. -0.0659

## 10 Oct 2007 9649 9012. 0.0707

## # ℹ 110 more rowsWe can review the residuals to determine if their are any underlying

patterns left. Note that the index is class yearmon, which

is a regularized date format.

augment_fit_ets %>%

ggplot(aes(x = index, y = .resid)) +

geom_hline(yintercept = 0, color = "grey40") +

geom_point(color = palette_light()[[1]], alpha = 0.5) +

geom_smooth(method = "loess") +

scale_x_yearmon(n = 10) +

labs(title = "US Alcohol Sales: ETS Residuals", x = "") +

theme_tq()## `geom_smooth()` using formula = 'y ~ x'

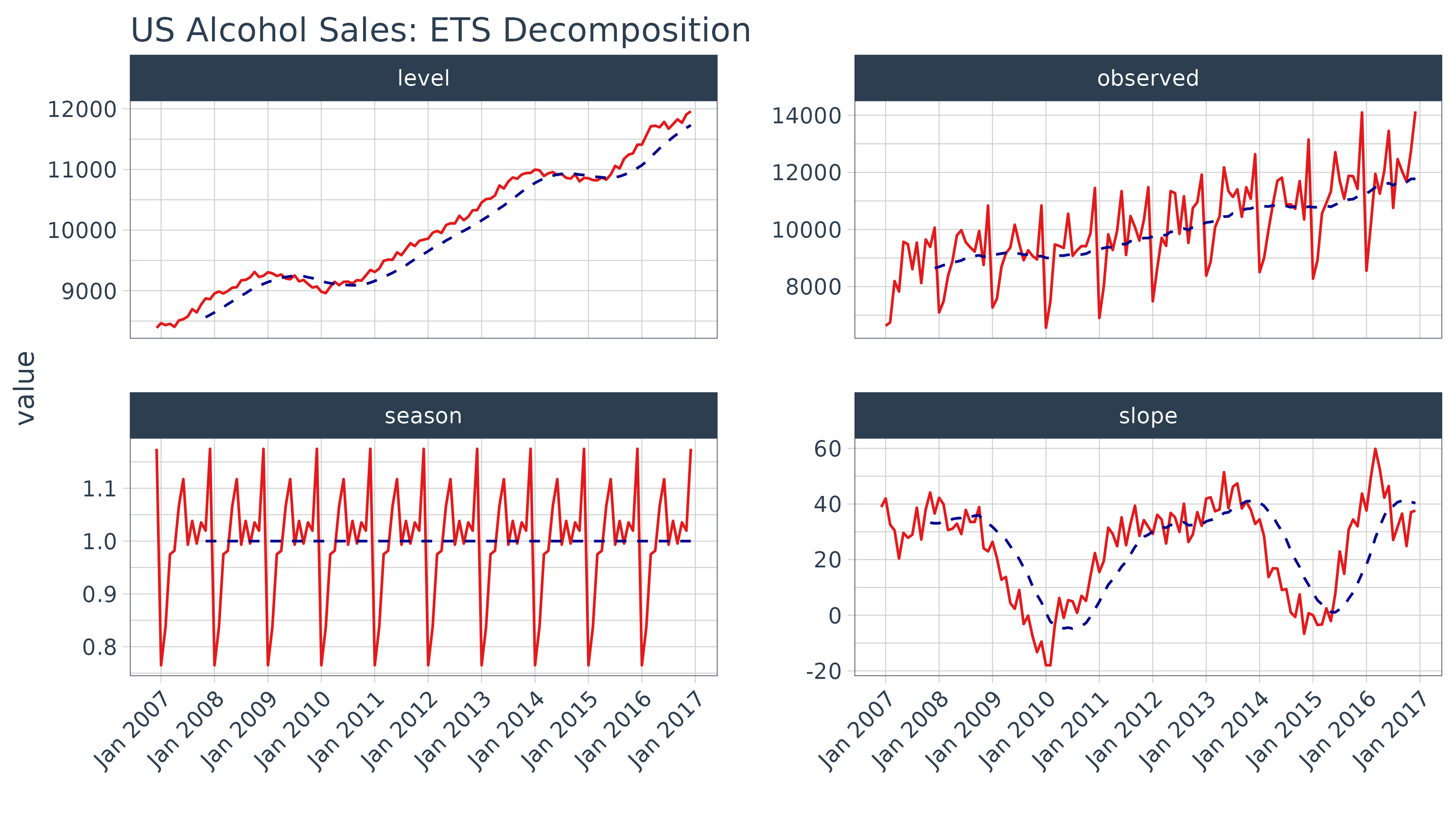

sw_tidy_decomp

sw_tidy_decomp() returns the decomposition of the ETS

model.

decomp_fit_ets <- sw_tidy_decomp(fit_ets)

decomp_fit_ets ## # A tibble: 121 × 5

## index observed level slope season

## <yearmon> <dbl> <dbl> <dbl> <dbl>

## 1 Dec 2006 NA 8389. 39.1 1.18

## 2 Jan 2007 6627 8464. 42.4 0.764

## 3 Feb 2007 6743 8440. 33.8 0.835

## 4 Mar 2007 8195 8465. 32.0 0.973

## 5 Apr 2007 7828 8420. 22.2 0.981

## 6 May 2007 9570 8521. 30.9 1.07

## 7 Jun 2007 9484 8542. 29.0 1.12

## 8 Jul 2007 8608 8580. 29.4 0.997

## 9 Aug 2007 9543 8698. 39.0 1.04

## 10 Sep 2007 8123 8650. 28.1 0.995

## # ℹ 111 more rowsWe can review the decomposition using ggplot2 as well.

The data will need to be manipulated slightly for the facet

visualization. The gather() function from the

tidyr package is used to reshape the data into a long

format data frame with column names “key” and “value” indicating all

columns except for index are to be reshaped. The “key” column is then

mutated using mutate() to a factor which preserves the

order of the keys so “observed” comes first when plotting.

decomp_fit_ets %>%

tidyr::gather(key = key, value = value, -index) %>%

dplyr::mutate(key = as.factor(key)) %>%

ggplot(aes(x = index, y = value, group = key)) +

geom_line(color = palette_light()[[2]]) +

geom_ma(ma_fun = SMA, n = 12, size = 1) +

facet_wrap(~ key, scales = "free_y") +

scale_x_yearmon(n = 10) +

labs(title = "US Alcohol Sales: ETS Decomposition", x = "") +

theme_tq() +

theme(axis.text.x = element_text(angle = 45, hjust = 1))## Warning: Removed 1 row containing missing values or values outside the scale range

## (`geom_line()`).

Under normal circumstances it would make sense to refine the model at this point. However, in the interest of showing capabilities (rather than how to forecast) we move onto forecasting the model. For more information on how to forecast, please refer to the online book “Forecasting: principles and practices”.

Step 3: Forecasting the model

Next we forecast the ETS model using the forecast()

function. The returned forecast object isn’t in a “tidy”

format (i.e. data frame). This is where the sw_sweep()

function helps.

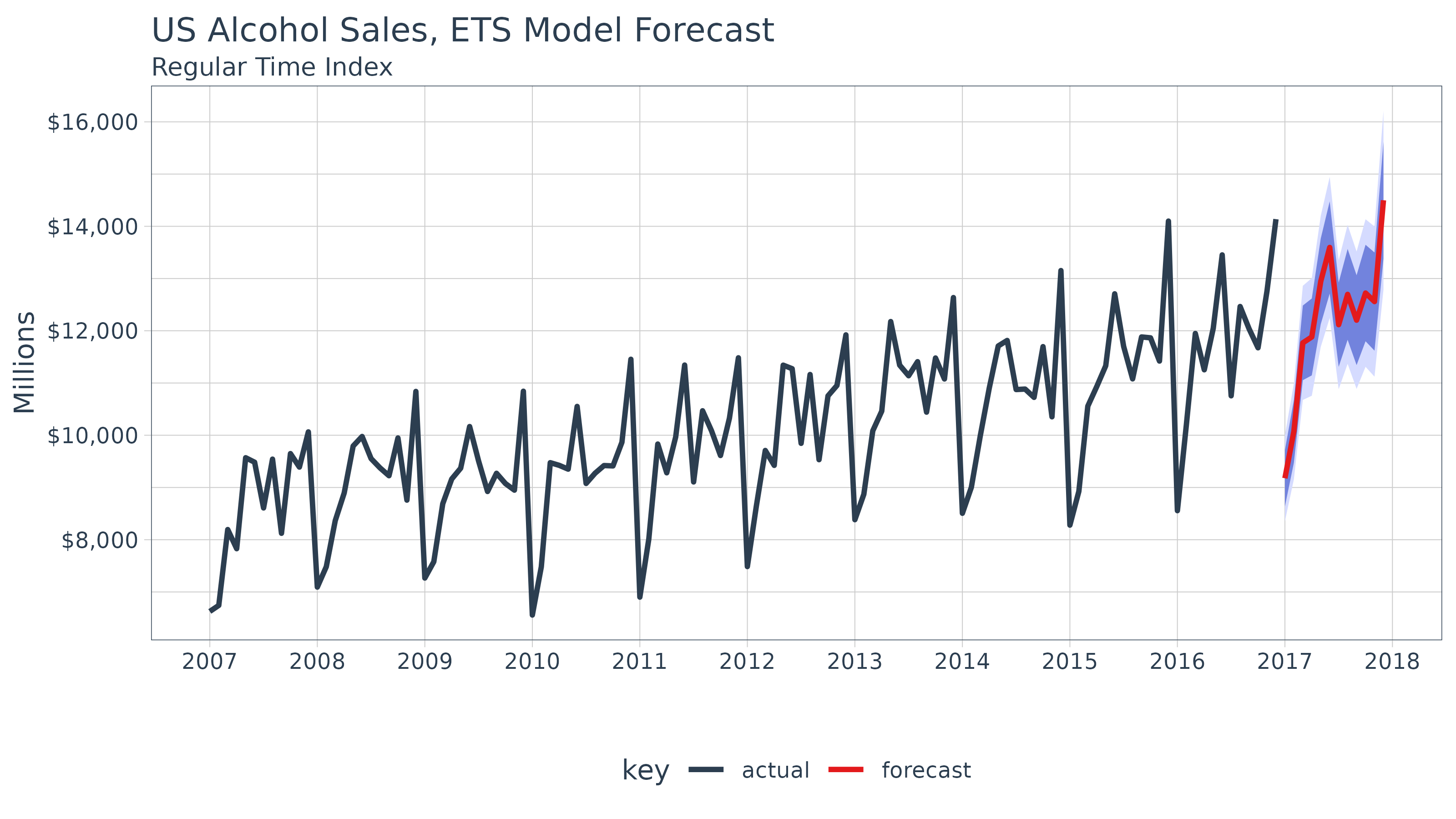

Step 4: Tidy the forecast object

We’ll use the sw_sweep() function to coerce a

forecast into a “tidy” data frame. The

sw_sweep() function then coerces the forecast

object into a tibble that can be sent to ggplot for

visualization. Let’s inspect the result.

sw_sweep(fcast_ets, fitted = TRUE)## # A tibble: 252 × 7

## index key price lo.80 lo.95 hi.80 hi.95

## <yearmon> <chr> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 Jan 2007 actual 6627 NA NA NA NA

## 2 Feb 2007 actual 6743 NA NA NA NA

## 3 Mar 2007 actual 8195 NA NA NA NA

## 4 Apr 2007 actual 7828 NA NA NA NA

## 5 May 2007 actual 9570 NA NA NA NA

## 6 Jun 2007 actual 9484 NA NA NA NA

## 7 Jul 2007 actual 8608 NA NA NA NA

## 8 Aug 2007 actual 9543 NA NA NA NA

## 9 Sep 2007 actual 8123 NA NA NA NA

## 10 Oct 2007 actual 9649 NA NA NA NA

## # ℹ 242 more rowsThe tibble returned contains “index”, “key” and “value” (or in this

case “price”) columns in a long or “tidy” format that is ideal for

visualization with ggplot2. The “index” is in a regularized

format (in this case yearmon) because the

forecast package uses ts objects. We’ll see

how we can get back to the original irregularized format (in this case

date) later. The “key” and “price” columns contains three

groups of key-value pairs:

- actual: the actual values from the original data

-

fitted: the model values returned from the

ets()function (excluded by default) -

forecast: the predicted values from the

forecast()function

The sw_sweep() function contains an argument

fitted = FALSE by default meaning that the model “fitted”

values are not returned. We can toggle this on if desired. The remaining

columns are the forecast confidence intervals (typically 80 and 95, but

this can be changed with forecast(level = c(80, 95))).

These columns are setup in a wide format to enable using the

geom_ribbon().

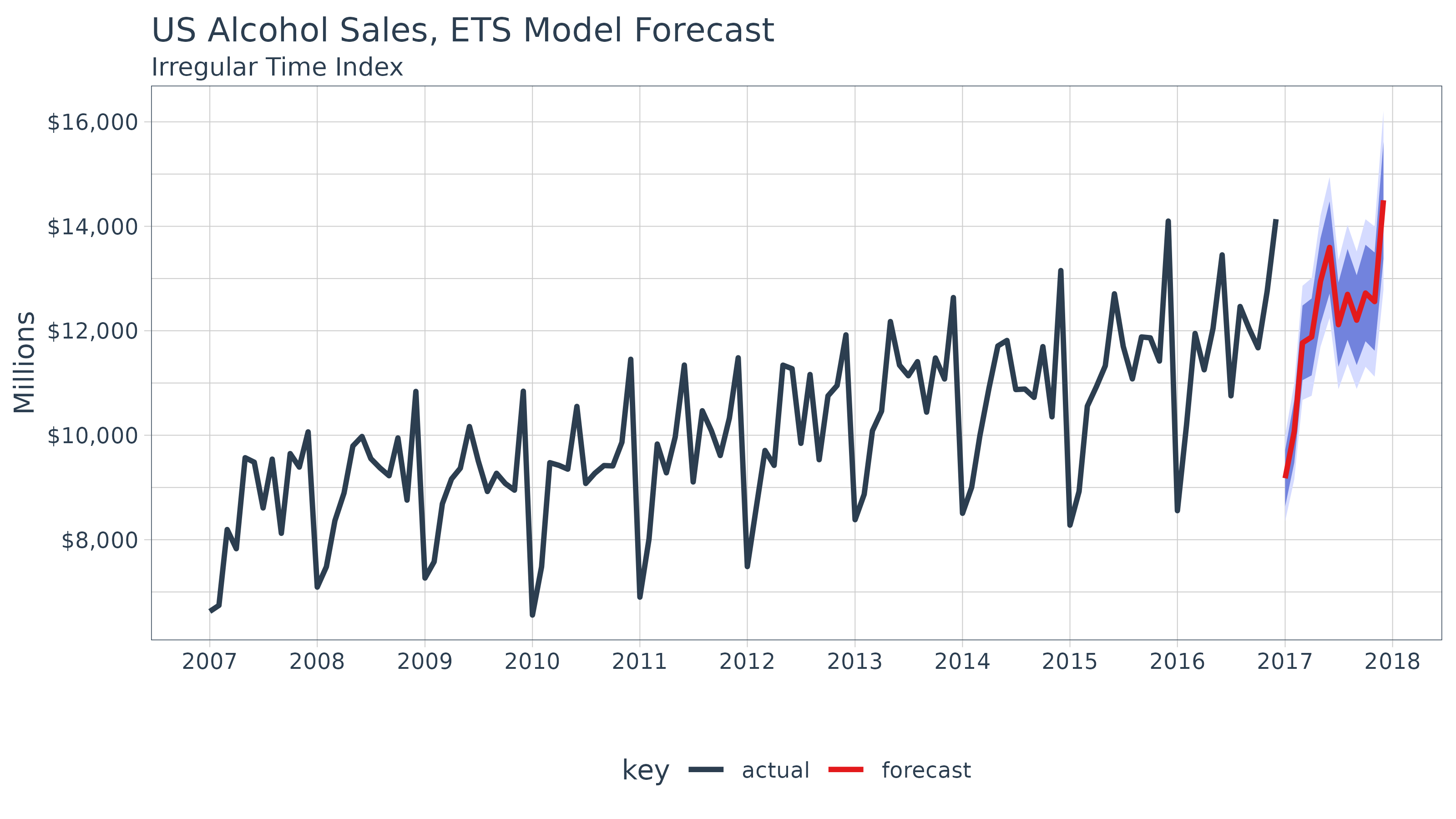

Let’s visualize the forecast with ggplot2. We’ll use a

combination of geom_line() and geom_ribbon().

The fitted values are toggled off by default to reduce the complexity of

the plot, but these can be added if desired. Note that because we are

using a regular time index of the yearmon class, we need to

add scale_x_yearmon().

sw_sweep(fcast_ets) %>%

ggplot(aes(x = index, y = price, color = key)) +

geom_ribbon(aes(ymin = lo.95, ymax = hi.95),

fill = "#D5DBFF", color = NA, linewidth = 0) +

geom_ribbon(aes(ymin = lo.80, ymax = hi.80, fill = key),

fill = "#596DD5", color = NA, linewidth = 0, alpha = 0.8) +

geom_line(linewidth = 1) +

labs(title = "US Alcohol Sales, ETS Model Forecast", x = "", y = "Millions",

subtitle = "Regular Time Index") +

scale_y_continuous(labels = scales::label_dollar()) +

scale_x_yearmon(n = 12, format = "%Y") +

scale_color_tq() +

scale_fill_tq() +

theme_tq()

Because the ts object was created with the

tk_ts() function, it contained a timetk index that was

carried with it throughout the forecasting workflow. As a result, we can

use the timetk_idx argument, which maps the original

irregular index (dates) and a generated future index to the regularized

time series (yearmon). This results in the ability to return an index of

date and datetime, which is not currently possible with the

forecast objects. Notice that the index is returned as

date class.

## Warning in .check_tzones(e1, e2): 'tzone' attributes are inconsistent## # A tibble: 6 × 7

## index key price lo.80 lo.95 hi.80 hi.95

## <date> <chr> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 2007-01-01 actual 6627 NA NA NA NA

## 2 2007-02-01 actual 6743 NA NA NA NA

## 3 2007-03-01 actual 8195 NA NA NA NA

## 4 2007-04-01 actual 7828 NA NA NA NA

## 5 2007-05-01 actual 9570 NA NA NA NA

## 6 2007-06-01 actual 9484 NA NA NA NA## Warning in .check_tzones(e1, e2): 'tzone' attributes are inconsistent## # A tibble: 6 × 7

## index key price lo.80 lo.95 hi.80 hi.95

## <date> <chr> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 2017-07-01 forecast 12169. 11368. 10945. 12969. 13393.

## 2 2017-08-01 forecast 12680. 11824. 11371. 13535. 13988.

## 3 2017-09-01 forecast 12212. 11366. 10918. 13059. 13507.

## 4 2017-10-01 forecast 12773. 11862. 11380. 13683. 14165.

## 5 2017-11-01 forecast 12574. 11651. 11163. 13496. 13985.

## 6 2017-12-01 forecast 14540. 13442. 12860. 15639. 16221.We can build the same plot with dates in the x-axis now.

sw_sweep(fcast_ets, timetk_idx = TRUE) %>%

ggplot(aes(x = index, y = price, color = key)) +

geom_ribbon(aes(ymin = lo.95, ymax = hi.95),

fill = "#D5DBFF", color = NA, linewidth = 0) +

geom_ribbon(aes(ymin = lo.80, ymax = hi.80, fill = key),

fill = "#596DD5", color = NA, linewidth = 0, alpha = 0.8) +

geom_line(linewidth = 1) +

labs(title = "US Alcohol Sales, ETS Model Forecast", x = "", y = "Millions",

subtitle = "Irregular Time Index") +

scale_y_continuous(labels = scales::dollar) +

scale_x_date(date_breaks = "1 year", date_labels = "%Y") +

scale_color_tq() +

scale_fill_tq() +

theme_tq() ## Warning in .check_tzones(e1, e2): 'tzone' attributes are inconsistent

In this example, there is not much benefit to returning an irregular time series. However, when working with frequencies below monthly, the ability to return irregular index values becomes more apparent.